New perspectives for a new year?

Article written by Gocar Data – The analysis and opinions expressed in this article are those of the author only and not those of OPENLANE Europe.

In Gocar Data’s last articles, they analyzed the various impacts of COVID-19 on the European automotive sector through different aspects. As the new year started, they took one step back and made a “bigger picture” update on the market to identify the short and long-term trends they are seeing.

Volume: it’s complicated, but…

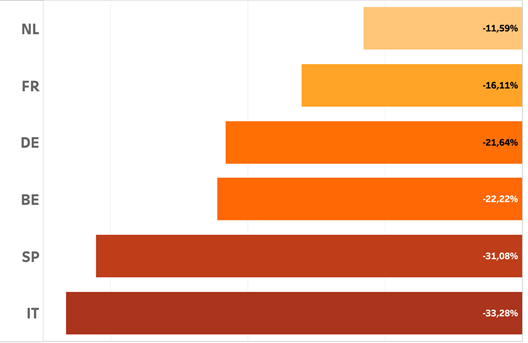

The market is looking for cars, but there is a general shortage. The latest figures analyzed by Gocar Data on the online available vehicles confirm this. In December, all markets had a large percentage of fewer available cars compared to 2020 or 2019. The largest gaps can be found in Italy, -33% compared to December 2020, and in Spain, -31%. This is obviously a difficult situation.

Graph: evolution YTD

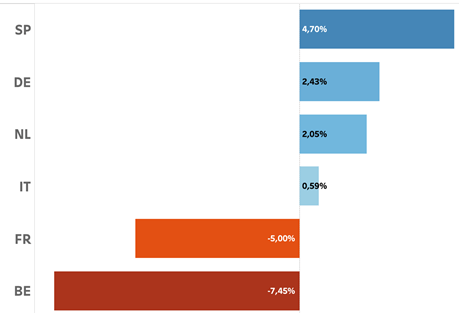

But there could be a positive trend. If they compare the volumes against those of November, Gocar Data is seeing a stabilization. After months of continuous descent, it’s too soon to be overjoyed, but it’s a positive sign. Some markets, and not the least, are even going up, like Germany (+2,43% in one month) and Spain (+ 4,7%). Gocar Data will keep a close eye on these volumes to see if this was just temporary or if it’s a sign that we’ve reached the lowest point.

Graph: evolution Nov. to Dec. 2021

Leading brands

Volkswagen and Mercedes vehicles are both in the top three brands, but Volkswagen is consistently ranked higher (except in Belgium). The impact of local makes is still as strong as ever. As expected, three German makes are in the top three in Germany. The French market is dominated by French makes and in Italy, Fiat is still the historical leader. BMW is only represented twice in the top three (in Belgium and Spain), but always at the first place.

Graph: makes ranking

Rotation: Some cars move fast, some don’t

Gocar Data is tracking all published vehicles on all relevant portals. When looking at the rotation, they have discovered two indicators which seem to go in opposite directions but are showing a two-faced situation.

On the one hand, they see that the average stock days for professionals are rising when they compare December 2020 with 2021. On the other hand, the percentage of recent publications is also rising.

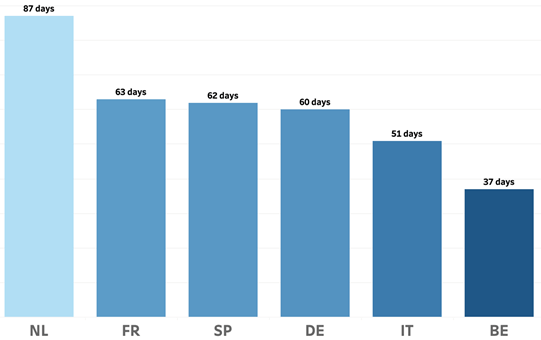

The average stock days for professional sellers:

Overall, this indicator seems disappointing. With five out of six countries around or above 60 stock days, it seems to prove that the market still has issues in selling the products in stock.

Only Belgium seems to be in a positive situation with 37 days on average.

Some cars are selling extremely fast while others have more issues finding a buyer. There could be many reasons such as fiscal reasons or local Low Emission Zone regulations. Cross-border sales, in which OPENLANE is very strong, can be a real opportunity for these vehicles, as they are more attractive in other European markets.

Pricing: going up, up, up

In the previous article, Gocar Data focused on a few models in particular and showed that prices were clearly on the rise. Today, they will look at the global markets.

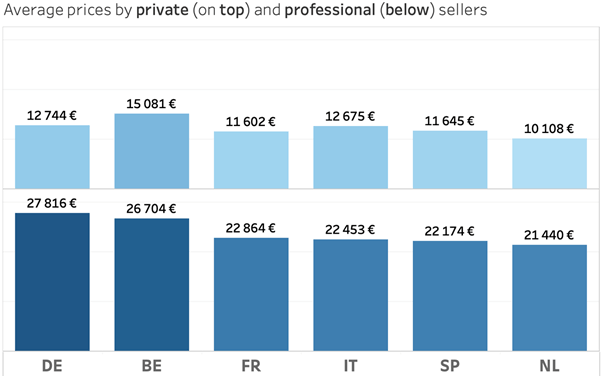

When they compare the average price of the cars sold by professional or by private sellers between December 2020 and 2021, there is a consistent rise in all markets:

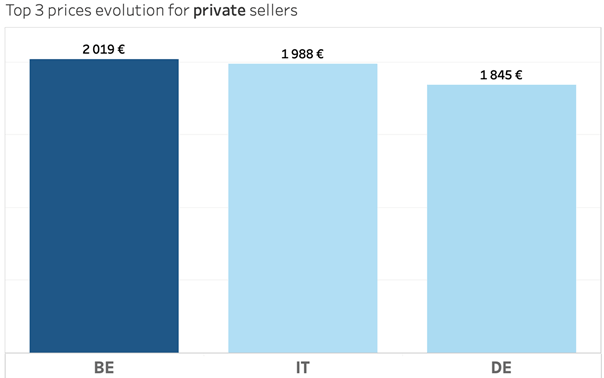

For private sellers, Belgium, Italy and Germany have the highest price increase:

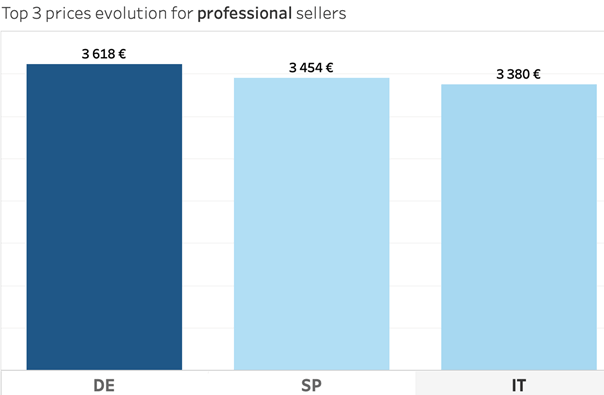

For professional sellers, Germany, Spain & Italy are in the top 3 positions:

Again, this study shows how markets are reacting differently to the situation. It also demonstrates that there are opportunities for cross–border activities. Maximize your revenues now by selling your cars with OPENLANE!