Margin is a good path to make a benefit. But it might not be the only one!

In our previous article, we analyzed how a better understanding of the end price of each vehicle was a key factor for a successful auction process. For sellers, targeting on a wide range of markets makes sure that the highest selling country is among them, helping the optimization of the sales result. And for buyers, by highlighting the local consumer price, it allows them to auction at a higher price than colleagues from other markets, and still make a good profit.

Today, we’ll understand how a wide market knowledge, not only focused on the price or the margin, can enhance the results of an auction, by bringing together the right products (and their sellers) with the right target.

The main assumption of our analysis is that, for a seller, the best way to sell a vehicle, whether locally or cross border, is not only defined by the consumer end price, but also by the expected time to sell. In parallel, for buyers, understanding the speed of rotation can highlight vehicles that are profitable on the long run, even with a lower margin.

First, we’ll start with a fictional scenario, to explain the mechanism. Later on, we’ll go for real examples to demonstrate how the effect can impact the auctions.

Let’s consider a dealer. He buys a car on auction of 10.000 € with an expected consumer price of 15.000 €, according to the pricing analysis of Gocar Data. On the same day, the dealer across the street also wins an auction for a car at 10.000 €. But our pricing analysis provides a target of 12.000 € as sale price. Intuitively, everyone thinks the first dealer is in a much better position. Higher margin potential brings more benefits.

The problem here is that it only gives a partial vision of the real situation. By using the Gocar Data market observation, we can predict an expected time to sell of 35 days for the first vehicle, and only 10 days for the second one. In this situation, after 10 days, the second dealer can buy, again, a new vehicle with the revenues of the first sale. And once more after 10 days. In the same interval it would take for the first dealer to sell its vehicle (around 35 days), producing 5000 € margin, its competitor has made 3 sales, with a total of 6000 € in his pocket. And 3 customers on the road, so more opportunities for after-sale revenues.

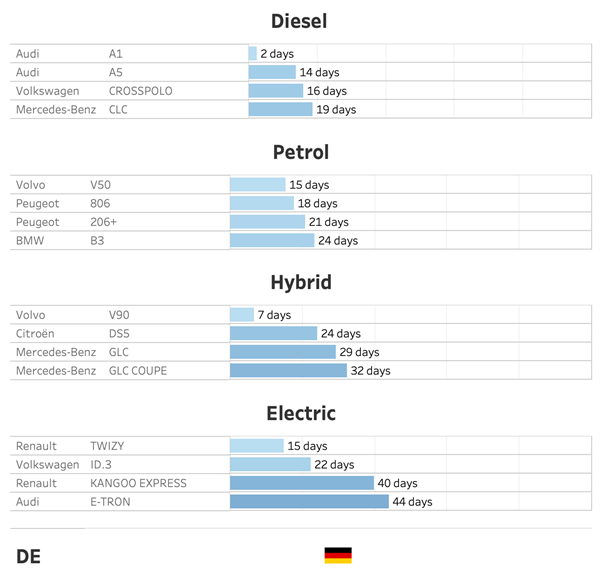

For each market, we can detail the vehicle models with the highest potential of rotation, so with the lowest time to sell. Once again, the volatility between markets is high, and offers many opportunities. Even if the consumer market price could seem equal between most markets, those with a shorter time to sell are the best places to maximize the value of the assets.

In this table (German figures), we’ve only focused on the main makes. But every day, for each market, new vehicles auctioned are golden opportunities. The key element to optimize this is to provide all the involved parties with a transparent and comprehensive vision of the market parameters.

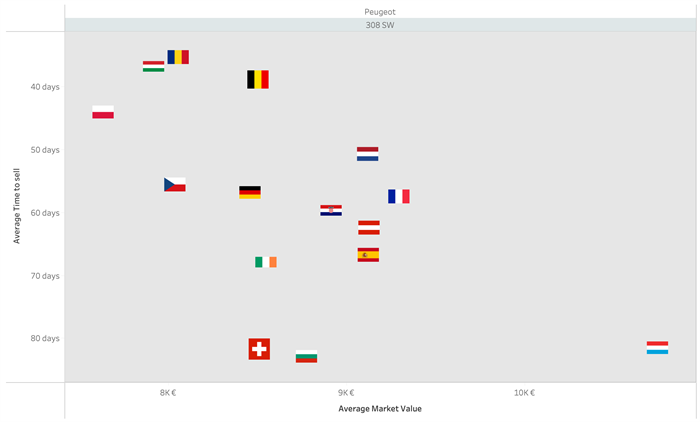

Even the most mainstream models have a wide distribution when we analyze the expected time to sell for each country.

For this model, Luxemburg would seem the ideal country, with the highest market value. But by combining the time to sell analysis, we also discover good opportunities for Romanian, Hungarian & Belgian buyers.

Conclusion

We see again that a data-driven decision can help the optimization of the revenues for all players. For sellers, understanding the right products to sell using cross border auctions creates value, obviously. At the same time, for buyers, understanding their local market with the right data helps to focus on the profitable vehicles, even if the margin is not huge. Vehicles with a low offer, or popular in demand (or even better both!) are a great addition for any stock!