Запаси от автомобили на дъното: ефектът на ценообразуването

Статията е написана и данните са предоставени от Gocar Data – Анализът и мненията, изразени в тази статия, са единствено на автора, а не на OPENLANE Europe.

В последната статия на Gocar Data през септември бяха обсъдени причините за ниските наличности на автомобили на всички европейски пазари. За съжаление оттогава ситуацията не се е подобрила. Gocar Data анализира развитието през последните три месеца.

При прегледа на запасите от автомобили от август до ноември някои от ключовите пазари остават стабилни: Във Франция, Нидерландия и Испания не се наблюдават големи промени. За съжаление, Белгия (- 4,48 %), Италия (- 7,23 %) и Германия (- 18,97 % налични автомобили!) все още са в низходяща тенденция. Като цяло тези шест пазара са загубили 8,57 % за три месеца.

И няма краткосрочно подобрение. По-важното е, че всички сигнали показват, че ситуацията ще продължи дълго. Някои дори прогнозират, че не можем да се надяваме да достигнем „нормална“ пазарна ситуация преди края на лятото на 2023 г.

И все пак пазарът продължава да се върти, както може. С ново поведение. Например, 22% от обявите, които Gocar Data съставя, изчезват за по-малко от 24 часа. Купувачите повече от всякога са нетърпеливи да се възползват от всички нови оферти и да сключват сделки възможно най-бързо, изпреварвайки конкуренцията. Всъщност имаме работа с пазар с две лица: от една страна, търсените автомобили се преследват ожесточено. От друга страна, по-малко търсените автомобили могат да останат на склад за дълго време. Понякога причината за липсата на успех на някои модели е много специфична за страната (например данъчно въздействие). Намирането на трансгранични купувачи, каквото може да предложи OPENLANE Европа, в много случаи ще превърне „проблемния автомобил“ в реална търговска възможност.

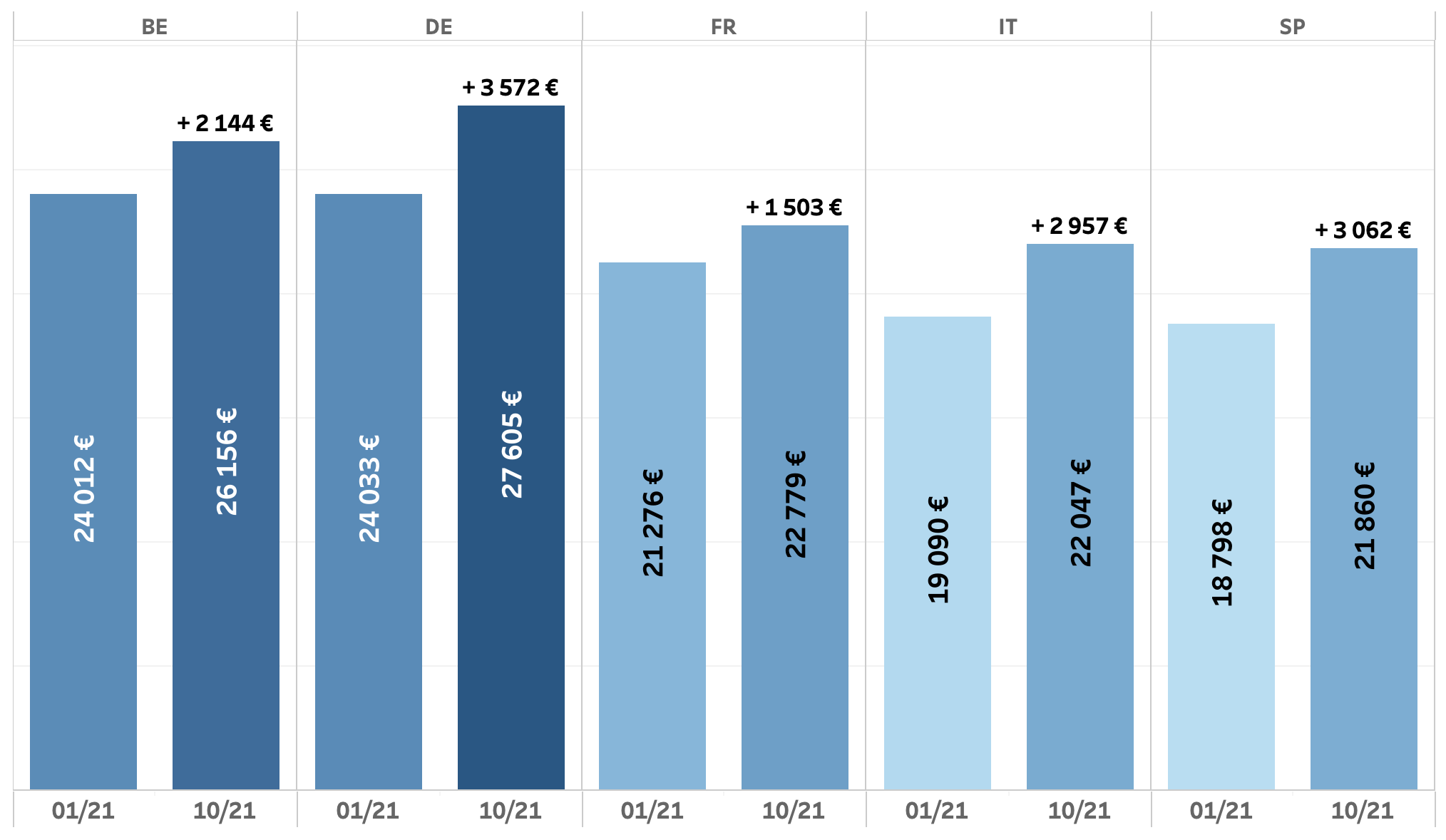

Както се очакваше, когато предлагането е ниско, а търсенето е стабилно или по-високо, има пряко въздействие върху цените. Очевидно е, че има разлики между пазарите, марките, видовете горива и т.н., но екипът на GocarData наблюдава и една обща тенденция.

Средна публикувана ценова делта по държави

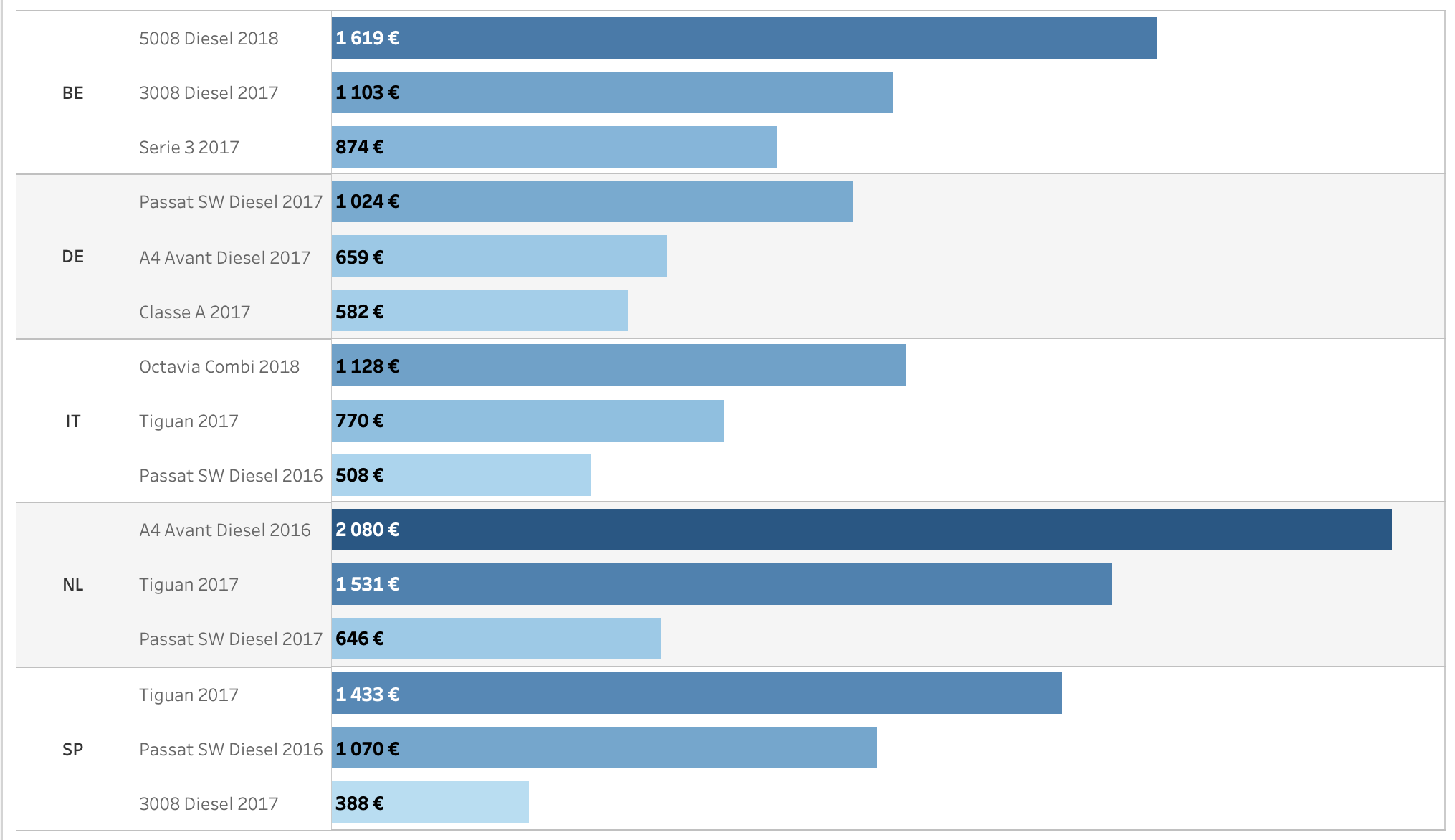

Gocar Data анализира няколко модела, които най-често се предлагат в търговете на OPENLANE Europe. Както споменахме по-рано, има големи разлики между пазарите и моделите.

Топ 3 на увеличенията на цените по държави (януари-октомври)

Успоредно с това се наблюдава и развитие на времето за продажба.

Топ 3 на намаленията на „времето за продажба“ по държави (януари-октомври)

Дори и цените на дребно да се повишават, автомобилите с много ниско време за продажба предлагат на купувачите реални възможности за положителни финансови резултати. Отново, това обикновено е вярно за правилните превозни средства. Въз основа на правилно наблюдение на пазара е възможно да се изберат превозни средства с ограничени наличности и високо търсене на местния пазар на купувачите.

Това със сигурност са трудни времена за автомобилната индустрия. Въпреки това, както и в повечето сложни времена, намирането на по-добри начини за управление на наличностите, ценообразуването и моделния микс ще й позволи да надмине пазара. Повече от всякога разбирането на фактите, измерването на ежедневните промени и бързите и интелигентни действия са ключовите фактори за успех.